529 Plans

TL;DR There’s a tax-advantaged investment account called a “529 Plan” that lets you save money for your children’s (or another beneficiary’s or your own) education. You contribute post-tax dollars into a 529 Plan and as long as the money stays in the account, the accrued earnings are not taxed. Some states also offer tax breaks for contributions. You can change the beneficiary and multiple people can contribute to the account. If you do want to withdraw the money for non-educational purposes, there is a penalty and the proceeds are taxed.

Congrats! You just became a parent and you’re starting to think about your child’s future. One natural question that comes up is: "How do I set my kids up for college today?" Contributing to a 529 Plan is one way to start making progress toward the cost of your child’s education.

What is a 529 Plan?

A 529 Plan is a tax-advantaged investment account you can use for a specific person’s education (does not have to be a family member). You can use the money in your 529 Plan for qualified educational expenses, including:

- College tuition

- College expenses (books/supplies, computers/internet access, room and board)

- K–12 tuition (limited to $10k/year for private, public, or religious elementary or secondary school)

- Certain apprenticeship costs

- Student loan repayments

Here is a list of common educational expenses and whether they qualify:

Who can set one up?

Anyone, of any age, with a Social Security or Tax ID number can be a beneficiary of a 529 Plan. (The beneficiary can even be the same person who sets up the account.) 529 Plans allow you to change the beneficiary if desired, but most people set up 529 Plans to pay for their children’s education expenses.

What are the benefits?

There are usually tax advantages for you to save in a 529 Plan. 529 Plans work like an after-tax retirement account, such as a Roth IRA. Any money you earn as a result of investing in the 529 Plan is not taxable (at least at the federal level) as long as the money is used for qualified education expenses. Depending on the state, states may offer no 529 deduction, a deduction for investment in any 529 Plan, or a deduction for taxpayers who contribute to that specific state's plan:

Some states also have residency requirements for any tax deductions. (For example, New York offers $5k if single/$10k if married filing jointly, but you have to live in the state.) See the full table in the appendix to confirm the 529 Plan tax deductions and residency requirements for your particular state.

How do I set one up?

Any US resident over the age of 18 with a US address and a Social Security number or Tax ID can open a 529 Plan. There are no income restrictions to opening an account.

When you’re picking a plan, keep in mind that some states have higher management fees than others. Once you’ve picked a provider, you can open an account relatively easily and start contributing. Multiple people can contribute to these accounts.

When should I start thinking about this?

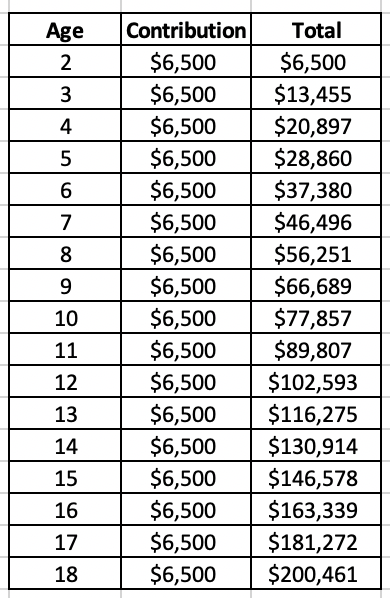

Generally, you should start thinking about setting up a 529 Plan as soon as you have a child so the funds can compound for a longer period of time before being withdrawn. Let’s put this into practice. Assume you have a 2-year-old child who will start college at 18 years old. Assume their college will cost $200K and you invest in a standard S&P 500 ETF via a 529 Plan that will average 7% per year:

So if you contribute $6.5k/year to your 529 Plan, you can be on your way of having enough for your child’s tuition when they enter college. That’s about $550 per month.

You can also gift into an existing 529 Plan. That means family members like grandparents, aunts, uncles, etc. can make contributions to the account. Under the current gift tax, you can give up to $16k/year (or $32k as a married couple) to an unlimited number of recipients. Anything after that eats into your lifetime gifting exclusion ($12.06M currently). Beyond the lifetime gifting exclusion amount (what CPAs might call the “unified credit”), you get taxed at 40% if you do not do any other tax planning.

You can “super fund” your 529 Plan with five years of gifting exclusion upfront (5 x $16k) with a process called “gift-tax averaging.” The benefit of this is again, more dollars compounding over more time. This should be weighed against the risk that you overfund an account or the possibility your child does not want to go to college, so consider your particular situation before deciding to super fund your 529 Plan.

What if I want to withdraw the money?

Withdrawals from a 529 Plan account can be taken at any time, for any reason. However, if the money is not used for qualified education expenses, income taxes will be due on any investment gains you withdraw, in addition to a 10% federal penalty tax and possible additional state or local taxes. When withdrawing money from a 529 Plan, a pro-rated portion of the amount saved and the investment earnings are paid out with each distribution.

In another scenario: let’s say you were overly ambitious with contributions, the market did really well, and there’s too much money in the account. The flexibility of 529 Plans allows you to update the beneficiary to another child or family member, which may be an attractive option if you want to avoid those penalties.

Why would I not want to open a 529 Plan?

Tuition payments made directly to a college are not considered gifts for tax purposes, so if you are or expect to be above the current gift tax exclusion ($12.06M), it could make more sense to pay for college tuition directly (this gets counted as a "tax free gift") instead of through a 529 Plan.

Bottom Line

529 Plans may be a great way to start saving for your child’s education today. In the event that your financial situation changes (or maybe your child decides college isn’t for them and wants to found a startup instead), they are relatively flexible, and can be re-assigned to a new beneficiary who needs to pay for education expenses.

Appendix

Here is a table of state-specific deductions: